Dividend

It has been on the declining trend since 2013 to 2016 majority due to the weakness of Singapore market where CDLT derive more than 60% of the total portfolio NPI which were due to more competition from the new hotel room supplies and weak SGD. Acquisition between 2013 to 2015 has support the dividend to be in the range of 10 cents.

Q4 dividend include one-off consumption tax refund of S$2.5 million (JPY 205 million) relating to the Japan Hotels acquisition which mean the dividend would have been lower.

| 2013 | 2014 | 2015 | 2016 |

| 10.97 | 10.98 | 10.06 | 10 |

| -3.09% | 0.09% | -8.38% | -0.60% |

Singapore New Hotel Supply and RevPAR

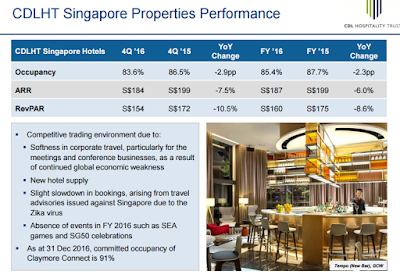

From 2013 to 2016 the average new room supply was around 3000 per year and in 2017 estimate it will be another estimate 3000 rooms. This will is will likely put the RevPar under the pressure further. Seem it will only take a breath only in 2018 and a little bit challenge in 2019. This provided there is no significant backlog being carry to 2018 and tourist keep coming and go up and up.

Maldives

The environment seem very challenging the sad part it was just acquired in early and end of 2013.

The Maldives Resorts recorded a YoY collective RevPAR (USD) decline of 14.7% and 25.1% in 4Q 2016 and FY 2016 respectively. The decline in NPI was partially mitigated mainly by the recognition of minimum rent for Angsana Velavaru and this is the 2nd time the minimum rent is recognized. Total minimum rent has been recognize is US$1 million out of US$ 6 millions

UK Hotel

Enjoying a good growth with uncertainty due to the impending commencement of the formal EU exit negotiations in March 2017

Quoted from the presentation slide

- Hilton Cambridge City Centre recorded a YoY RevPAR (GBP) growth of 10.8% and 11.9% in 4Q 2016 and FY 2016 respectively

- The growth was largely fuelled by healthy demand, the refurbished product as well as the rebranding of the hotel during the year

- Negative currency translation resulted in lower NPI contribution despite stronger underlying hotel performance

Australia Hotels

Quoted from the presentation slide

- NPI for 4Q 2016 increased 4.2% YoY due to the stronger AUD during the quarter

- Coupled with the increase in new hotel rooms supply in Perth and Brisbane, trading performance of the hospitality sector will likely remain challenging

- However, any weakness is mitigated by the defensive lease structure which provides CDLHT with a high proportion of fixed rent

Otherwise the revenue will be under pressure, below quoted from FY15 annual report on Australia market review

Based on forecast supply and historic trends it is expected that occupancy levels will continue to decline over the medium term to 2018 and reach a trough in the low 70% range, after which demand is expected to exceed supply and occupancy is forecast to increase again

New Zealand

Enjoying a good growth in NPI mainly due to revised lease structure with higher variable income.

Quoted from the presentation slide

- NPI for 4Q 2016 more than doubled YoY mainly due to:

- Strong underlying performance of the hotel with a YoY RevPAR (NZD) growth of 4.9%

- Higher variable income under the revised lease structure which benefited from the burgeoning tourism market in New Zealand

To note on the potential supply in the future

- Park Hyatt Wynyard Quarter – The 196-room, Construction has begun on site and the hotel is expected to open in mid to late 2017.

- Ritz Carlton – 266-room Ritz Carlton hotel suggested a completion date of 2020, however the current status of the building is unknown.

- There are few more development with the unknown completion date

Japan Hotel

Japan hotel seem to have enjoying the growth in 1Q16 to 2Q16 and start to feel the competition in 3Q16 onward as

- a combined yoy RevPAR (JPY) drop of 6.6% for 3Q 2016

- a combined YoY RevPAR (JPY) drop of 5.0% for 4Q 2016

Based on industry journals available,it was announced that approximately 10,700 hotel rooms,and Ryokan rooms are planned for opening in Tokyo by,2019. For example, "Keio Presso Inn Hamamatsucho" with 330 rooms in Minato-ku, Tokyo and "APA Hotel RyogokuEkimae",with 1,000 rooms in Sumida-ku, Tokyo are scheduled to open in winter 2017 and April 2018 respectively.

Summary

- Weakness in Singapore market currently was supported by the recent acquisition between 2013 to 2015, this is basically the asset has growth but the dividend is less and stagnant around 10 cents.

- Singapore segment will take sometime to recover as the new supplies will still coming till 2019, RevPAR likely will still under pressure or stabilize at best

- Japan Hotel start to see drop in RevPAR, something need to be watch out in the future.

- Uncertainity in UK segment due to Brexit

- Maldives continue to face challenge and has utilise US$1 million out of 6 million minimum rent.

Seems like a no buy for CDLHT.

ReplyDeleteHi Arthur,

ReplyDeleteIt will all depend on your investment approach