Key take away for me

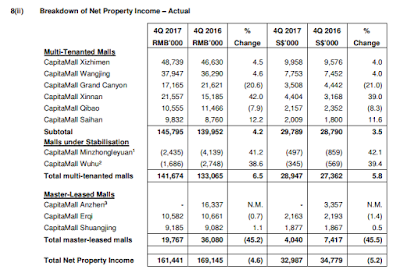

- Q4 Distribution include $3.7 million gain from Anzhen disposal.

- CapitaMall Minzhongleyuan have negative rental reversion of 31.4% and occupancy rate is not yet improved still at 78% , this is below my expectation - seem it will take sometime for the mall to stabilised

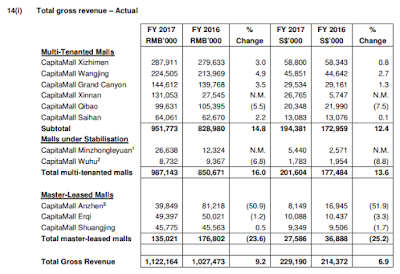

- Rock Square will start to contribute revenue from Feb 18 onward. I don't think this acquisition can fully off-set the lost from Anzhen as in FY16, Anzhen itself contribute about $13.9 million to the net property income whereby based on the illustration Rock Square will contribute about $6.3 million per year which far from Anzhen distribution hence will distribution in FY18 supported by $31.5 million divestment gain? even so, it will need to catch up with the difference otherwise dividend will drop considering the outstanding unit also increased by additional 64,392,000 due to this acquisition

- CapitaMall Grand Canyon register 9.3% drop in revenue and 20.6% drop in net property income due to one time event in Q4 which might carry over to Q1FY18.

- CapitaMall Qibao facing competition and resulted drop in 7.9% in net property income and this has been happening since few quarters ago. FY17, total drop is 10.3% in net property income

- Gearing is 34% post-acquisition of Rock Square

- Occupancy rate is just slight dip from 95.6% to 95.4%

For FY18, seem the dividend to be supported will come from

- Rock Square contribution and rental reversion

- Turn around of CapitaMall Minzhongleyuan

- Disposal gain from CapitaMall Anzhen

- Another acquisition?

Current revenue seem does not suggest it will be able to sustain 2.37 cent dividend without disposal gain support.

No comments:

Post a Comment