MNACT Q2 FY18/19 Result Review

The result is pretty good in my opinion due to

- Historical positive rental reversion

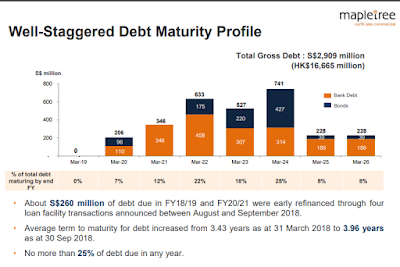

- Only 7% of debt will be maturing in Mar 2020

- New source of income diversification from Japan Properties

- Percentage of management fees paid in cash has increase to 12.9%, in the past it has been paid in units of MNACT

Debt

The average interest rate has inch up from 2.44% in previous quarter to 2.48% which is likely due to the refinancing for the loan due in Mar 19 and partial amount due in Mar 21.With the refinancing, there will be no debt need to be refinance in Year 2019 and the next refinancing will be $206m in Mar 2020.

The management has provide guidance an increase of 50bps will reduce the dpu payout by 0.072 cent. If we assume the annual DPU will be 7.7 cent based on 1.926 quarter DPU, the impact of interest rate will be minimal

Proportion of fixed interest rate remain at 78%

Rental Reversion

It has a good up rental reversion and historically it has positive rental reversion (see the 40% positive reversion and it is anchor tenant!)Lease Expiry

Potential organic revenue growth if management can keep the rental reversion for upcoming lease that expired. On another flip coin, I worry how long the manager can keep this good track record

Receivable

It has recognized the refundable consumption tax of S$25.2 million by the tax authorities arising from the acquisition of the Japan Properties resulted to boost MNACT cash to $184mFinancial Ratio

- Gearing 39%, increase from 36.2%

- Average effective Interest Rate 2.48%, increase from 2.44%

- Interest Coverage Ratio 4.1 remain same as previous quarter

- Next debt refinancing 7% of total debt in Mar 2020

- Occupancy rate 99.6%

No comments:

Post a Comment