Dividend Payout

Q4 FY18 DPU of 1.78 cent is lower than Q3 FY18 of 1.8 cent in term of Singapore dollar however in term of Australian dollar is is higher from 1.76 to 1.78 cent of Australian dollar.Exchange rate hedge at A$1:S$1.0011 and current exchange rate is A$0.99:S$1.00

The management has provide guidance on the exchange rate impact to the DPU

A 100 bps points increase in the AUD:SGD and EUR:SGD exchange rates will result in an increase of 0.02 Singapore cents in DPU

A$2 million distribution from divestment gain is include in Q4 FY18.

Revenue

There is additional A$1.9 million relates to the early surrender fee received for Lot 105 Springhill Road, Port Kembla, New South Wales. This property is up for renewal in 20 Aug 2019 and the space have been taken up by another tenant with 3 year lease from Aug 18.Few item there will impact the revenue

Acquisition of the 21 properties in German and Netherland is only from 25 May to 30 Sep.

Acquisition of one Australia property is only contribute from 5 Sep to 30 Sep

Divestment of 2 Australia is in 17 and 20 Aug so there is no income from 20 Aug to 30 Sep

Debt

Nothing much change from the previous quarter- Healthy Interest coverage ratio at 7 times

- Interest Rate 82% fixed

- Average cost borrowing 2.5%

- Gearing at 34.6%

Lease Expiry

Well spread lease expiry with average around 10% except for 2022 and 2026Management Fees

For Q4 FY18, The management fees paid 100% in unit as for FY18 is 88.2% in unit. I will wish more management fees paid in cash while maintaining the DPU.Rental Reversion

Average rental reversion is negative at -3.2%There is one -19.8% rental reversion however this property only contribute A$ 1.2 million to gross revenue in FY17 where by for 55-59 Boundary Road, Carole Park, the rental reversion at 3.9% and the gross revenue in FY17 is A$1.7 million

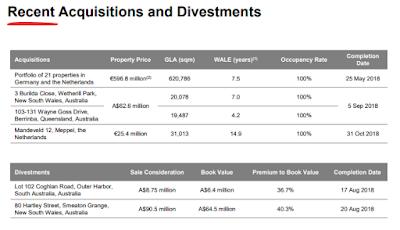

Divestment and Acquisitions

In summary, the divestment will cause lost of around A$ 9 million whereby the Acquisition will add additional around A$ 6 million. Note one in gross revenue term and one in NPI term.Divestment of A$ 98 million also net A$ 23 million gain, A$ 2 million distributed in Q4 FY18 and A$ 62.6 million used to fund the acquisition

Acquisition

31 Oct 18, Mandeveld 12 in Mepple, The Netherlands which will bring in additional A$ 2 million and it fully funded by debt. The purchase price is approximately S$ 39.88 million

5 Sep 18, Properties lease hold and free hold in Australia which will bring in additional NPI of AUD 4 million. The acquisition is fully funded by divestment of 2 Australia property. The purchase price is A$ 62.6 million

Divestment

20 Aug 18, 80 Hartley Street in Australia for around S$ 90 million which net S$ 17 million gain. The property contribute around A$ 7.9 million to gross revenue in FY 2017

17 Aug 18, Lot 102 Coghlan Road in Australia for around A$ 8.75 million which net almost A$ 2 million gain. The Property contribute around A$ 1 million gross revenue in FY2017

No comments:

Post a Comment