Dividend

For Q4FY16 and Q1FY17, no management fees were paid in unit yet the management able to maintain 2.51 cents dividend compare to previous year Q1FY16 where 23% of management fees were paid in units. To note there is 0.28 cents from capital distribution to support income loss which include 0.9m from the disposal of the Hotel development rights at China Square Central in August 2015 which target to complete by mid 2019. Without 0.9m support the dividend would be reduced by around 0.11 cents which translate to 2.4 cents dividend. Still pretty decent for me.Lease Expiry profile

About 17.1% (5.4 % is HP) of total gross rental income in 2017 and the significant will be 29.4% in 2018 (12.1% is HP)FY2017 Lease Expiry

- 5.1% - China Square Central average passing rent are $6.9 (office) and $7.4(retail)

- 1.4% - 55 Market Street average passing rent $7.2

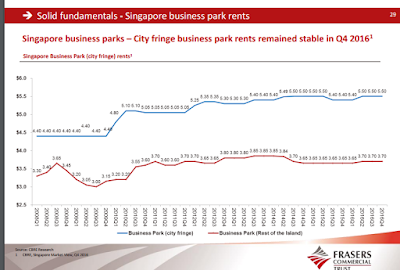

- 8.2% - Alexandra Technopark average passing rent $4.2

- 0.6% - Central Park average passing rent A$569 (office) and A$4623(retail)

Based on the below chart, seem it will be able to maintain the expiry lease average passing rent for the office if they are able to renewed it for China Square and 55 Market Street.

As for the Alexandra techno park, I am expecting a drop in the income due to HP moving out which contribute about 17% ++ and it is represent 5.4% out of 8.2% and not far into 2018 it will have another 12.1% of the trust gross rental income. If the manager manage to re-lease the whole space it will be a bonus for me.

For the Central park, it is not significant however the current range is between A$600 to A$725 and the current occupancy rate is just 80% on the positive side, it will have 10-20% upside if the rental market recover.

Step-up rent built in

Debt Profile

Average SGD debt rate is 2.59% and there will be 180m to refinance in FY17. Based on the last issuance of $100m at 2.835%, likely the debt rate will go up.Summary

1. If HP to vacate the space, it will depend on the management how fast it can re-lease the space as it is currently contribute about 17% of the gross rental income to the portfolio.2. I am expecting interest rate increase should be minimal impact to the dividend, however it will reduce the dividend

3. If market is giving an offer due to the item 1 above, i will consider to add more.

*Currently vested with FCOT at the time of writing

Past post on Frasers Commercial Trust

No comments:

Post a Comment