There has been few negative news revolving Lippo Karawaci(LPKR) which is the largest Master Payee for First Reit, some of the link below to the news

1. Downgrade by Moody

2. Corruption by some of LPKR Senior Employee

Receivable has increase from 29m in Q2 to 49M in Q3, an increase of 20M. The Manager shared it has received 17.5m in 15 Oct and the quarterly report is ended on 30 Sep, hence it is a late but it is late on advance rental payment (Oct to Dec).

This is basically related to LPKR cash flow issue highlighted in the news above.

Current Average Effective Interest Rate is around 4% and for the fixed interest rate it is hedge for 2 years (No clarity on when the hedge will end) and the debt on fixed rate proportion 59%.

As we are in the raising interest rate environment, we could expect it might be refinanced with higher interest rate.

I took a quick glance on Siloam Hospital Financial report and does not seem Siloam Hospital having issue on their cash flow. SILO current asset is higher than their total debt.

Next, I took a look at Lippo Karawaci Financial report ended Mar 18 which has 51.05% interest in SILO. Their current ratio which is the current asset/current liabilities actually quite high at 5.

Looking into one level down in LPKR financial report,

Below are their debt maturity

With the recent corruption charges, their sales on Meikarta project might be impacted as Me as an investor, I will avoid the project that has dispute.

Looking at LPKR financial report, I will hold my First Reit for now while monitoring their financial and on the corruption charges. However DPU might be impacted by the raising interest rate.

While looking at those company, I found Mr Ketut Budi Wijaya has position on those company, interesting.

1. Downgrade by Moody

2. Corruption by some of LPKR Senior Employee

First REIT Financial,

Nothing much has change a few some of the key item I would like to keep in mindReceivable

This has been concern for many First Reit shareholder and it is one of the highlight in analyst report.Receivable has increase from 29m in Q2 to 49M in Q3, an increase of 20M. The Manager shared it has received 17.5m in 15 Oct and the quarterly report is ended on 30 Sep, hence it is a late but it is late on advance rental payment (Oct to Dec).

This is basically related to LPKR cash flow issue highlighted in the news above.

Debt

First REIT has a debt of 100m that will need to be refinanced by Nov 18 and 10m to be refinance in Mar 19. It is currently in negotiation with the bank to extend. The next debt need to be refinance is $182.1m in FY2021 which 2-3 years from now.Current Average Effective Interest Rate is around 4% and for the fixed interest rate it is hedge for 2 years (No clarity on when the hedge will end) and the debt on fixed rate proportion 59%.

As we are in the raising interest rate environment, we could expect it might be refinanced with higher interest rate.

Now, PT Lippo karawaci (LPKR) - Account for 82.4% of First REIT Income

I took a quick glance on Siloam Hospital Financial report and does not seem Siloam Hospital having issue on their cash flow. SILO current asset is higher than their total debt.

Next, I took a look at Lippo Karawaci Financial report ended Mar 18 which has 51.05% interest in SILO. Their current ratio which is the current asset/current liabilities actually quite high at 5.

Looking into one level down in LPKR financial report,

Current Asset (in the report 45,022,456)

Below I only take those that i think is liquid- Cash and equivalent : 1,873,233

- Available for Sale Financial Asset : 6,799,644

- This is include their holding in LMIR and First REIT (which they have disposed half of their holding and now the holding at 10.63% of the total First Reit issued unit)

- Other Current Financial Assets : 2,250,580

- Inventories :29,835,373

Current Liabilities (in the report 8,887,980),

Some of the interesting Item out of those figure- Advances from Customers: 2,428,184

- Sale and Leaseback Transactions : 263,712

- This is interesting as I guess it is related to FIRST REIT as we can find the detail in their foot note 45.b

Now, looking at their long term debt

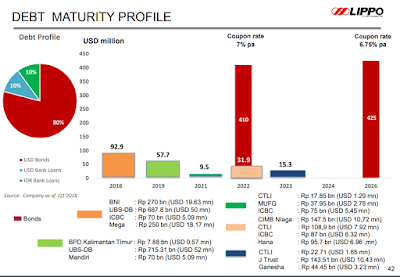

Below are their financial ratioBelow are their debt maturity

For the cash flow,

It is currently generating negative cash flowConclusion

As per report in many website, if LPKR has cash flow problem they might want to sell some of their asset to fund their cash flow which they did with their disposal 100% disposal on Bowsprit and 10.63% in First Reit.With the recent corruption charges, their sales on Meikarta project might be impacted as Me as an investor, I will avoid the project that has dispute.

Looking at LPKR financial report, I will hold my First Reit for now while monitoring their financial and on the corruption charges. However DPU might be impacted by the raising interest rate.

While looking at those company, I found Mr Ketut Budi Wijaya has position on those company, interesting.

No comments:

Post a Comment